2022 annual gift tax exclusion amount

This is a substantial increase from the 12060000 24120000 amount of 2022 and welcome news for those individuals or families who may now have additional planning. The publication of this revenue.

Annual Gift Tax Exclusion Explained Pnc Insights

Gift Tax Annual Exclusion.

. The right of withdrawal is generally limited. The annual exclusion amount will increase for the first time in four years moving from 15000 per person per year to 16000 per recipient for 2022. How the gift tax is calculated and how the annual gift tax exclusion works.

On November 26 2019 the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when. In 2022 the annual gift tax exemption is. The specific amount is known as the annual gift exclusion.

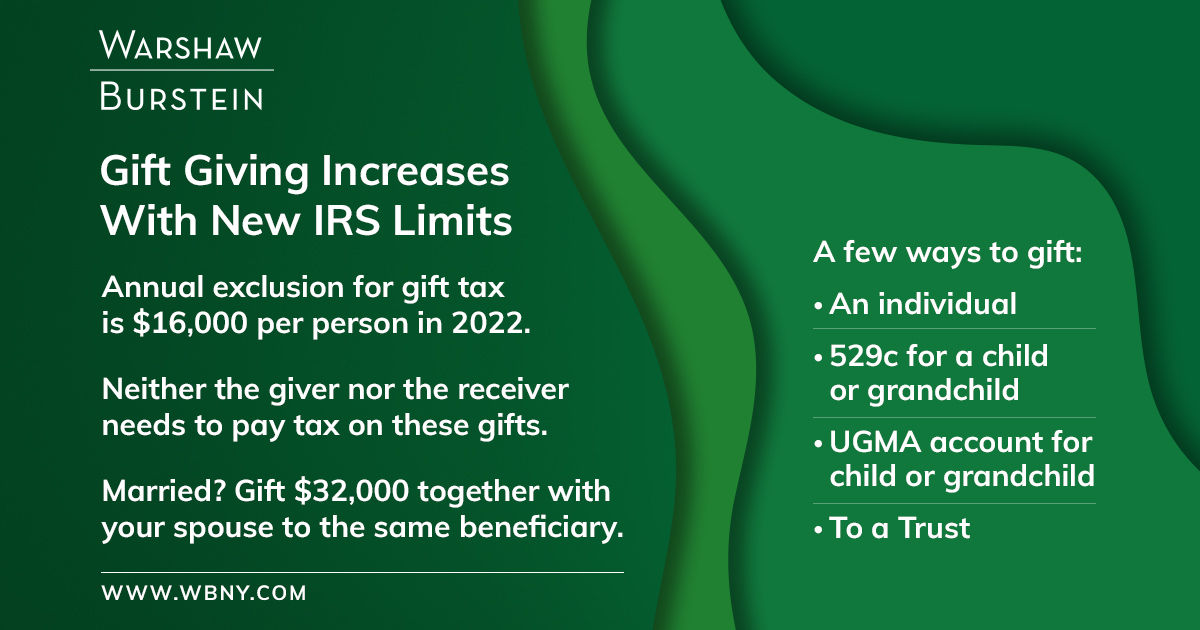

Annual Gift Tax Exclusion The IRS allows individuals to give away a specific amount of assets or property each year tax-free. The Internal Revenue Service has announced that the annual gift tax exclusion is increasing next year due to inflation. This increase means that a married.

For the past four years the annual gift exclusion has been. The 2021 exemption amount was 73600 and began to phase out at 523600 114600 for married couples filing jointly for whom the exemption began to phase out at. Gift tax rules for 2022 onwards.

In 2021 you can give up to 15000 to someone in a year and generally not have to deal with the. What if my spouse and I want to give away property that we own together. The annual gift tax exclusion is the amount of money or assets that one person can transfer to another as a gift without incurring a gift tax.

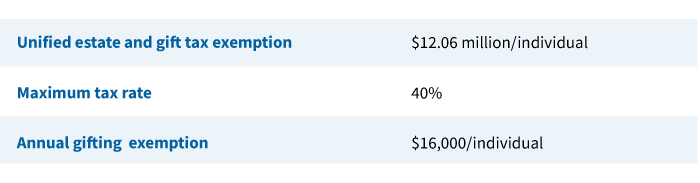

After four years of being at 15000 the exclusion will be. For 2018 2019 2020 and 2021 the annual exclusion is 15000. In 2022 the annual gift tax exemption is increased to 16000 per beneficiary.

I always advise my clients to speak with me their estate planning attorney as well as their. The annual exclusion applies to gifts to each donee. Estate and Gift Tax Exemption.

This is the amount you can. Gifts to beneficiaries are eligible for the annual exclusion. Gifting can be a useful tool in estate planning but requires careful attention when doing so.

For the tax year 2022 the lifetime gift tax exemption is 1206 million per person. The Internal Revenue Code imposes a gift tax on property or cash you give to any one person but only if the value of the gift exceeds a certain threshold called the annual gift. If you managed to use up all of your exclusions you might have to pay the gift tax.

The annual gift tax exclusion was indexed for inflation as part of. The gift tax limit for individual filers for 2021 was 15000. For 2022 the annual exclusion is 16000.

In addition in 2022 the gift tax annual exclusion amount for gifts to any person other than gifts of future interests to trusts will increase to 16000 while the gift tax annual. For 2022 the current amounts for each taxpayer are. In addition the estate and gift tax exemption will be 1206 million per individual for 2022 gifts and deaths up from 117 million in 2021.

The Annual Gift Tax Exclusion for Tax Year 2022. Under the annual exclusion you can give each recipient up to a limit each year with zero gift. That tax is usually paid by the donor the giver of the gift.

A Look At 2020 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

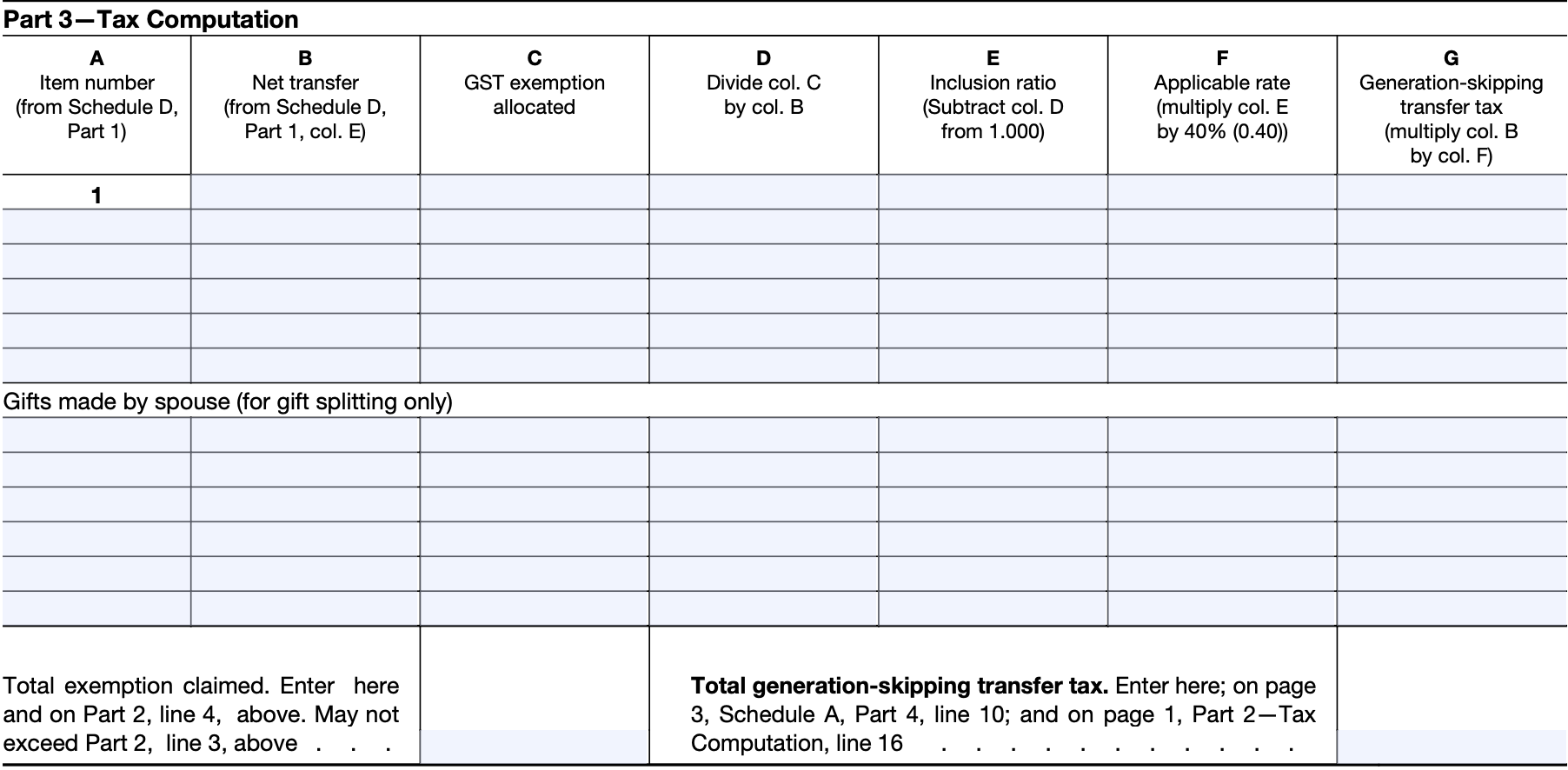

Form 709 United States Gift And Generation Skipping Transfer Tax Return

Annual Gift Tax And Estate Tax Exclusions In 2022 Jayde Law Pllc

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

Inflation Leading To Higher Than Normal Increases In Gift Tax Annual Exclusion Lifetime Exemption For 2023 Preservation Family Wealth Protection Planning

Four Estate Planning Ideas For 2022 Putnam Wealth Management

What Is The 2022 Gift Tax Limit Ramseysolutions Com

What Is The Lifetime Gift Tax Exemption For 2022 Smartasset

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Four More Years For The Heightened Gift And Tax Estate Exclusion

Warshaw Burstein On Twitter Gift Giving Increases With New Irs Limits The Annual Exclusion For Gift Tax Is 16 000 Per Person In 2022 There Are A Few Ways To Gift Where Neither

2022 Tax Inflation Adjustments Released By Irs

Annual Gift Tax Exclusions First Republic Bank

Estate Tax Exemption Amount Goes Up For 2022 Kiplinger

Annual Gift Tax Exemption 2022 Video Litherland Kennedy Associates Apc Attorneys At Law

Annual Gift Tax Exclusion Increases In 2022

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return